Running a small business involves countless decisions and responsibilities, and one crucial aspect that’s often overlooked is the need for commercial auto insurance. At Infinity Insurance Agency, Inc. (IIA), we believe this specialized insurance should be a priority for every business owner. Commercial auto insurance not only helps your business in the event of a covered accident but also can help ensure compliance with applicable laws. Unlike personal auto insurance, which often doesn't cover certain types of vehicle usage, commercial auto insurance provides the coverage you may need for business-related activities. Understanding these limitations underscores the importance of making commercial auto insurance a top priority for your business.

What is commercial auto insurance?

Commercial auto insurance is a specialized policy designed to help pay for damages to vehicles used for business purposes in a covered accident. Whether it's delivering goods, transporting tools, or carrying employees, business-related vehicle use can vary widely. For many business owners, these vehicles are essential to their daily operations and overall success.

Commercial auto insurance is crucial because it provides tailored coverage that personal auto insurance often doesn't. This includes higher liability limits, protection for business-related equipment, and coverage for employees who drive company vehicles. By purchasing commercial auto insurance, your business may be financially prepared if you encounter risks associated with its vehicle operations.

Commercial vs. personal use

It’s simple. A personal auto insurance policy is used for your personal vehicle. This policy may include coverage for things like liability claims, medical payments, or collision protection. It all depends on the coverage you choose. Here are additional differences between commercial auto insurance and personal auto insurance:

Commercial use activities

- Transporting goods or merchandise

- Driving to multiple work sites or client locations

- Using a vehicle for rideshare or taxi services

- Hauling tools, equipment, or hazardous materials

Personal use activities

- Commuting to and from a single workplace

- Running personal errands

- Vacation travel

- Driving children to school or activities

Get A Commercial Auto Quote Now

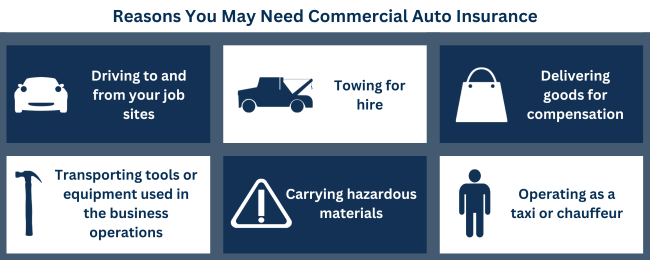

Do I need commercial auto insurance?

If you use your vehicle for business purposes beyond commuting to and from work, you may likely need this type of insurance policy. This includes using the vehicle to transport goods, visit clients, or if the vehicle is registered to the business. Commercial auto can be customized to help cover additional equipment attached to the vehicle and cargo in the vehicle.

LIST OF BUSINESSES THAT TYPICALLY REQUIRE COMMERCIAL AUTO INSURANCE

Certain types of businesses are more likely to require commercial auto insurance, including:

- Delivery services (e.g., food delivery, courier services)

- Construction and contracting

- House painting

- HVAC repair

- Mobile car detailing

- Landscaping

- Cleaning services

- Carpet cleaning

Is commercial auto insurance required?

In many jurisdictions, commercial auto insurance is a legal requirement for businesses that use vehicles in their operations. Even in areas where it’s not mandated, having commercial auto insurance is highly advisable to help mitigate the financial risks associated with accidents, damage and liability.

Here is a breakdown of the types of business activities that would most likely require commercial auto insurance and activities that would most likely NOT require commercial auto insurance.

Require:

- Businesses that transport goods for a fee

- Companies with vehicles that carry heavy equipment or tools to job sites

- Businesses that regularly use vehicles to visit job sites, clients, or vendors

- Firms that have employees driving company vehicles

Not require:

- Businesses with no vehicular operations

- Sole proprietors who use personal vehicles only for commuting to and from work

- Freelancers working from home without the need for transporting goods

Five key benefits of commercial auto insurance

Protecting your employees and business equipment with insurance coverage is crucial. If you use your vehicle for work—whether it’s hauling cars, transporting business cargo and equipment, or meeting with clients—your personal auto insurance policy may not cover you.

As a business owner, you might wonder, “What does commercial auto insurance cover?” Here are five benefits that many organizations consider when choosing to invest in commercial auto insurance:

- Protect your employees and business equipment: Your employees are vital to your business, and their safety is a top priority. Commercial auto insurance helps pay for damage to your business vehicles and can also include protection for your employees, including new hires. Whether you operate a single delivery van or a fleet of vehicles, commercial auto insurance safeguards your business assets.

- Customized coverage: Beyond standard collision, comprehensive, and liability coverages, commercial auto insurance offers protection tailored to your business needs. It can cover employees using your vehicles for business operations and can be customized to include protection against non-collision damages, such as floods, fires, vandalism, and theft.

- Potential tax deduction: Commercial auto insurance may be classified as a business expense, which could make it tax deductible. For more details on how your car insurance can be a tax deduction, consult with your tax professional.

- Protection against liability claims: In the event of an accident involving one of your business vehicles, the at-fault driver could be held liable for damages. Without commercial auto insurance, your business could be responsible for covering the resulting expenses. Investing in commercial auto insurance can help mitigate these unexpected costs, potentially protecting your business’s financial health. Liability insurance can help protect your business from significant out-of-pocket expenses in the event of an accident.

- Compliance with legal requirements: In several states, like Pennsylvania and Arizona, commercial vehicles must have commercial liability insurance to operate legally. Ensure that you meet all the necessary requirements for the states in which you do business. If you operate across state lines, you may even be required to have a commercial policy by federal law.

What does a commercial auto policy cover?

A commercial auto insurance policy can include several key types of coverage:

- Medical payments coverage/Personal injury protection (PIP) (as applicable): Helps pay for medical expenses for you and your passengers in an accident, regardless of who is at fault. This could include your employees and/or new hires.

- Collision coverage: Helps pay for damage to your vehicle resulting from a collision with another vehicle or object.

- Comprehensive coverage: Helps to pay for damages caused from non-collision-related incidents, such as theft, vandalism, or natural disasters.

- Rental reimbursement: Helps to pay the cost of renting a vehicle while your business vehicle is being repaired after an accident.

- Liability coverage: Helps to pay for damages involving your business’ financial loss if you or an employee are found at fault for an accident that causes injury or property damage to others.

- Trailer insurance: Helps pay for damages to your trailer attached to your business vehicle when involved in a covered accident. This could include additional equipment attached to your vehicle and cargo being hauled.

Benefits of commercial auto insurance

- Comparable rates: Despite the broader coverage, commercial auto insurance policies can be competitively priced, especially when considering the significant financial protection they offer.

- Added value: Commercial policies often include added benefits like rental reimbursement, which can save your business money and minimize downtime.

- Broader coverage: Commercial auto insurance policies are designed to cover a wider range of risks associated with business operations.

Investing in commercial auto insurance is a smart move that can provide peace of mind and helps with your financial security in case of a covered accident, allowing you to focus on growing your business.

Call one of our agents today at 1-855-478-3705 for a free quote!

Get A Commercial Auto Quote Now